Budget 2021 Uk Capital Gains Tax

The annual exemption for 20212022 will remain at 12300 and the Chancellor announced that the annual exemption will remain at this amount for the tax years 202122 to 202526. 1 day agoFigures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four-fold from the 25billion achieved a decade ago.

Govt Deprived Of Tax On Capital Gains Icab In 2021 Capital Gain Business Pages Business

Chancellor Rishi Sunak has made some short term and long term changes to Business Rates which will be of interest to agents and other property professionals.

Budget 2021 uk capital gains tax. UK Budget 2021. Chancellor Rishi Sunak will deliver his second Budget for 2021 next week. The Governments budget for April 2021 largely avoided tax increases in a bid to restart the countrys economic growth engine read our budget summary here.

St Kitts And Nevis Citizenship By Investment. If instead you would like to read a brief overview of these potential changes please click here. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax rates.

That the current Capital Gains Tax rates may be. Capital gains tax reporting deadline changes. Capital Gains Tax is a levy charged on the profit a.

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. 1 day agoThe Budget has proven more generous than many expected - and with most property taxation left unchanged. Chancellor Rishi Sunak will lay out the governments latest tax and spending plans on Wednesday 27 October.

The threshold for capital gains tax is frozen at 12300 until 2026 but perhaps the chancellor will tinker with the rate instead The Times said. Rates allowances and exemptions for 2022-23 remain unchanged from 2021-22. Capital Gains Tax Brackets 2021 What They Are And Rates Capital Gains Tax Capital Gain Tax Brackets.

Budget 2021 uk capital gains tax. The rate you pay depends on your income level and the type of asset. Budget 2021 uk capital gains tax.

Find the best information and most relevant links on all topics related toThis domain may be for sale. It is typically paid by only around 275000 taxpayers and raises less than 10bn per annum. The following article is a detailed report on the proposed changes to Capital Gains Taxation for 2021 or 2022.

CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about the sale. Budget 2021 uk capital gains tax. Planning to simplify the way that alcohol is taxed in the UK.

1 day agoFind out more. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Capital gains tax CGT is the tax you pay on the profit when you sell something that has increased in value.

Capital Gains Tax has been discussed as an area for change for some time but this would be unlikely to raise significant amounts of tax. The time limit for making capital gains tax returns and. The letter comes after others have expressed concern that Capital Gains Tax could be an easy target in the Chancellors Autumn budget.

Details of the new Residential Development Tax have also been revealed with this being used to fund remediation work on. Any annual gain exceeding 12300 is. The penalty increased to 5 after six months.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Current capital gains tax rates of 10 and.

After 30 days the fine for failing to pay CGT was 100. The measure will bring around 25000 individuals into the scope of Capital Gains Tax in 2021 to 2022. The content of this article is intended to provide a general guide to the subject matter.

In the current tax year starting on 6 April 2021 and ending on 5 April 2022 this is 12300. Current capital gains tax rates of 10 and. CAPITAL GAINS TAX could be an easy target for the Chancellor Rishi Sunak in the upcoming autumn Budget an expert has warned.

As a result some may wish to. Capital gains tax CGT McEleney continued. Budget 2021 Uk Capital Gains Tax Rabu 27 Oktober 2021 Edit.

The rate you pay depends on your income level and the type of asset. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. If youre a basic-rate taxpayer you pay 10 on assets and 18 on property.

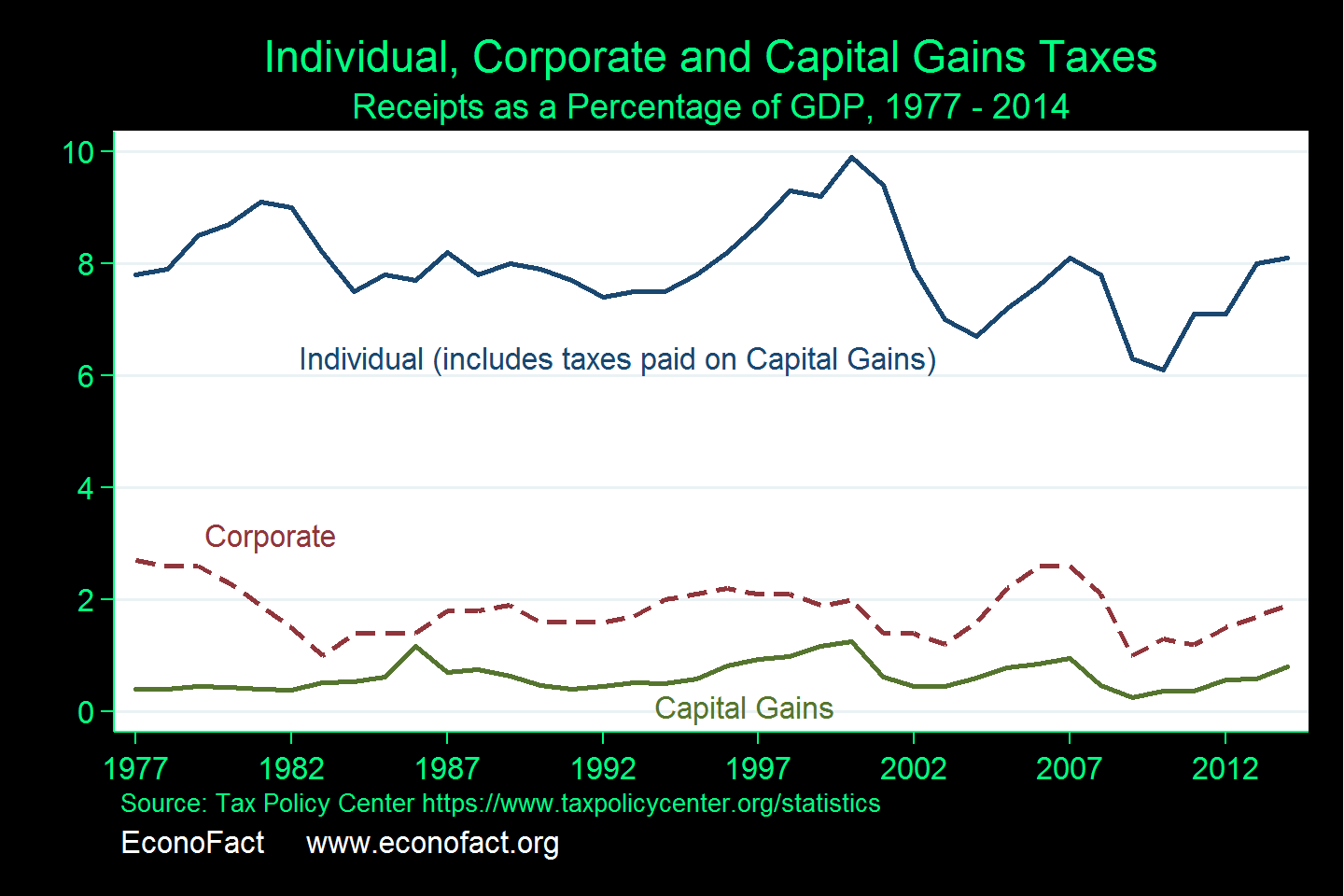

UK Tax Capital Gains Tax Corporate Tax. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax.

Capital Gains Tax rates and allowances. The penalty increased to 5 after six months. Budget 2021 uk capital gains tax.

Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. Capital Gains Tax Annual Exempt Amount AEA. Autumn Budget 2021 key points.

As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of 12300 for. Once again no change to CGT rates was announced which actually came as no surprise. 1223 Followers 302 Following 11 Posts - See Instagram photos and videos from abdou now online abdoualittlebit.

With the 125 increase in Employer NICs due to take effect in April 2022 and Corporation Tax set to rise from the current rate of 19 to 25 in April 2023 it is clear that the tax landscape for. Chancellor can go down in history as a great reformer if he fixes the disparity with income tax in Wednesdays budget Last modified on Wed 27 Oct 2021 0012 EDT Wednesdays budget. 9 hours agoOct 28 2021.

Specialist advice should be sought about your specific circumstances. 2 days agoWill capital gains tax increase at Budget 2021. NICs thresholds apply across the UK.

Price Reduction Need To Act Now Dixcart Group Limited. No changes were announced to the rates of capital gains tax with the higher rate remaining at.

The Average Percent Of Income Donated To Charity Can Improve

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

The States With The Highest Capital Gains Tax Rates The Motley Fool

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Capital Gains Tax Spreadsheet Shares In 2021 Capital Gains Tax Capital Gain Spreadsheet Template

Budget 2021 India In 2021 Budgeting Ration Card Tax Holiday

Tds Rate Applicable On Mf Redemptions By Nris For Ay 2021 22 Mutuals Funds Capital Gain Fund

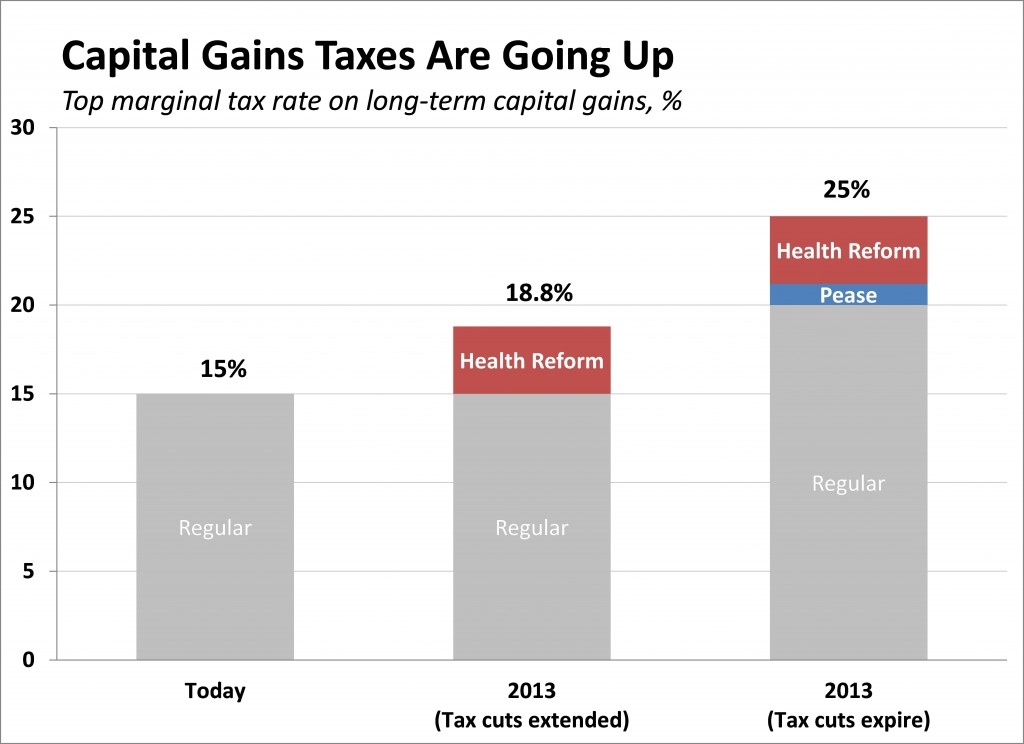

Capital Gains Taxes Are Going Up Tax Policy Center

Understanding The Tax Implications Of Stock Trading Ally

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

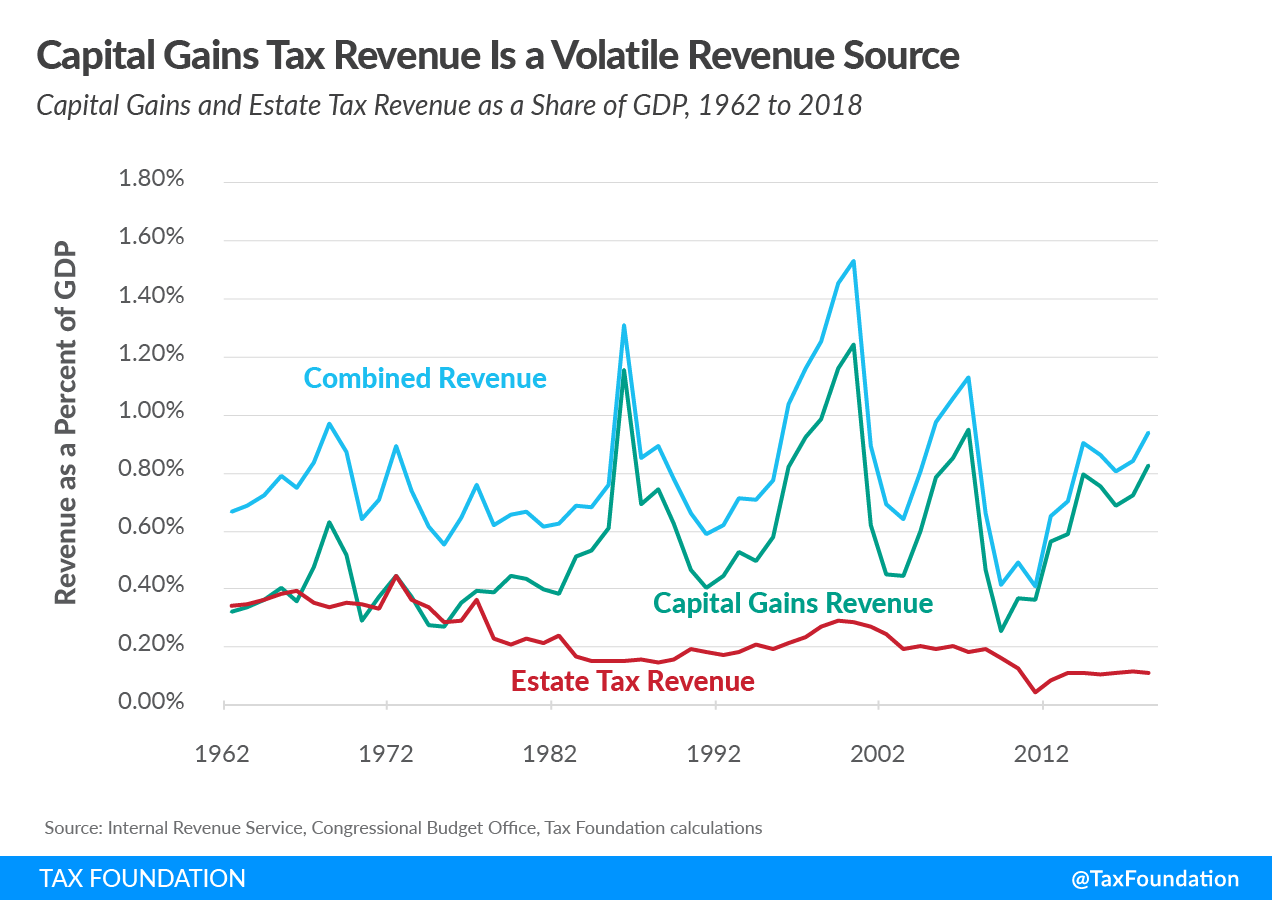

The Capital Gains Tax And Inflation Econofact

Guide To Capital Gains Tax Times Money Mentor

Capital Gains Tax Commentary Gov Uk

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atkinson2 Capital Gains Tax The Borrowers Budgeting

Mutual Fund Taxation 2017 18 Capital Gain Tax Rates Mutuals Funds Capital Gains Tax Investing